Consumers have a growing interest in owning a vehicle in the post-pandemic world, not only for convenience but also for safety assurances. In fact, rideshare services have been slow to return to their pre-pandemic pace of growth as people prefer using personal vehicles to satisfy their transportation requirements, according to a report from Deloitte.

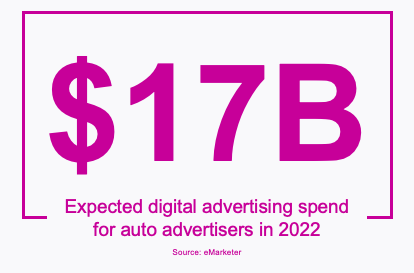

All of this is great news for automotive advertisers, who are expected to spend over $17 billion on digital advertising in 2022 in the US alone. But with supply chain disruptions, chip shortages and escalating shipping costs affecting the bottom line, it’s critical that automakers are getting the most out of their digital investments. If you’re an auto marketer competing to win the race for consumer attention, here are important trends of which to be aware:

Digital Touchpoints Matter

92% of car buyers globally research online prior to purchase. In fact, global car buyers use more than 6 digital touchpoints when researching a car to buy, according to Google. Getting the right messaging in front of car buyers in quality digital environments is vital.

Social Advertising Is Growing in Popularity

78% of consumers find social media useful when deciding on new automobile purchases, according to Facebook. Not surprisingly, social verification for DV’s auto clients grew 60% YoY, but, overall, they seem to be verifying their social campaigns less than other industries, according to DV data. Advertisers looking to explore advertising on social channels like TikTok, Facebook and YouTube, should strongly consider using verification tools to protect both their spend and brand reputation.

Video Advertising Makes an Impact on Car Buyers

Last year, over a quarter (26%) of automotive ads were video, compared with only 15% for other advertisers. This makes sense considering video is a great way to show off a new car model and 81% of car buyers research cars through online videos before making a purchase decision, based on a Google report. That said, auto advertisers will want to consider protection from fraud and unsuitable environments across video placements. DV Video Filtering is an industry-first solution that provides added protection for advertisers in video environments, such as CTV, where blocking fraudulent, non-brand safe or non-brand suitable and out-of-geo impressions requires a technology standard called VPAID — which is not widely available.

Budgets Are Shifting Away From Linear TV and Cable Toward Streaming and Connected TV (CTV)

TV spending by auto dealers fell 11.2% in 2021 and is expected to drop another 6% to $568.3 million in 2022. Cable is also stuck in reverse. Auto dealer spending on cable dropped 15% in 2020 and 3.1% in 2021. Meanwhile, streaming video spend jumped 35.7% in 2021 and is expected to increase 20% in 2022 to $1.75 billion, according to Borrell Associates. However, the adage holds true – fraud follows the money. Auto advertisers’ pre-bid fraud/SIVT violation rate on CTV was 52% higher than non-auto advertisers. Advertisers should be sure to work with an objective third party like DoubleVerify to help evaluate, detect and eliminate all manner of fraud within their media buys.

Download Our Auto Guide to Learn More

Be sure t o download our guide for the latest in-depth information about the state of media quality in the auto industry and learn more about best practices and solutions to maximize the efficiency and effectiveness of your campaigns.

o download our guide for the latest in-depth information about the state of media quality in the auto industry and learn more about best practices and solutions to maximize the efficiency and effectiveness of your campaigns.